Tasteful Selections® named in Inc. Magazine’s Annual List of America’s Fastest-Growing Private Companies—the Inc. 5000

Tasteful Selections ranks No. 3644 on the Inc. 5000 with three-year revenue growth of 93 percent

Inc. magazine revealed that Tasteful Selections® ranked No. 3644 on its annual Inc. 5000 list, the most prestigious ranking of the nation’s fastest-growing private companies. The list represents a unique look at the most successful companies within the American economy’s most dynamic segment—its independent small businesses. Intuit, Zappos, Under Armour, Microsoft, Patagonia, and many other well-known names gained their first national exposure as honorees on the Inc. 5000.

“We couldn’t be more excited to be featured once again on this year’s Inc. 5000 list,” Bob Bender, President of Tasteful Selections said. “The growth our company has seen in the last few years can easily be traced back to the wonderful employees that make up the Tasteful Selections team. We are eager to keep growing the team and our organization in the years to come.”

Tasteful Selections began their company growing 1,200 acres. Over the last 11 years, Tasteful Selections has grown to an operation that plants and harvests nearly 18,000 acres of bite-size potatoes year-round.

“The 2021 Inc. 5000 list feels like one of the most important rosters of companies ever compiled,” says Scott Omelianuk, editor-in-chief of Inc. “Building one of the fastest-growing companies in America in any year is a remarkable achievement. Building one in the crisis we’ve lived through is just plain amazing. This kind of accomplishment comes with hard work, smart pivots, great leadership, and the help of a whole lot of people.”

Not only have the companies on the 2021 Inc. 5000 been very competitive within their markets, but this year’s list also proved especially resilient and flexible given 2020’s unprecedented challenges. Among the 5,000, the average median three-year growth rate soared to 543 percent, and median revenue reached $11.1 million. Together, those companies added more than 610,000 jobs over the past three years.

Potato Market Update

All major russet potato-shipping areas are wrapping up their harvest. Growers in the Northeast still have some acreage to go before the season’s end. All areas appear to have average to slightly above average yields, with the exception of Idaho and Washington. These areas are forecasting a minimum shortage of about 20-percent. This may prove to be a problem in the next year as Idaho provides a lot of potato supply to the country. We will continue to monitor how this may affect pricing. Demand across the country continues to be average with firm pricing.

All major russet potato-shipping areas are wrapping up their harvest. Growers in the Northeast still have some acreage to go before the season’s end. All areas appear to have average to slightly above average yields, with the exception of Idaho and Washington. These areas are forecasting a minimum shortage of about 20-percent. This may prove to be a problem in the next year as Idaho provides a lot of potato supply to the country. We will continue to monitor how this may affect pricing. Demand across the country continues to be average with firm pricing.

Growers in the Red River Valley are shipping and storing red potatoes. Harvest is nearing 85 to 90-percent complete.

The yellow potato market is seeing steady pricing. Some areas are seeing supply exceed demand but overall the yellow potato market is steady.

Very little changes in the white potato market. Most of the demand remains centered in the North and Southeast.

Great fingerling potato supplies are available in all shipping areas; this variety is very promotable.

Onion Market Update

Growers in Idaho and the Columbia Basin have wrapped up onion harvest for the season. Overall, yields were down this year compared to past years due to the hot and smoky growing season. Growers are also reporting reduced onion sizing.

Growers in Idaho and the Columbia Basin have wrapped up onion harvest for the season. Overall, yields were down this year compared to past years due to the hot and smoky growing season. Growers are also reporting reduced onion sizing.

The overall demand remains very steady for red and yellow onions, with white onion demand slightly down. Pricing remains significantly higher on the larger-sized onions due to fewer supplies.

The warehouse and transportation industry recorded 490,000 openings in July. This has and continues to cause a tight transportation market. Flatbeds will no longer be an option as we head into winter, which will lead to more transportation delays.

Consumer's engage with sustainability based on environmental and social components

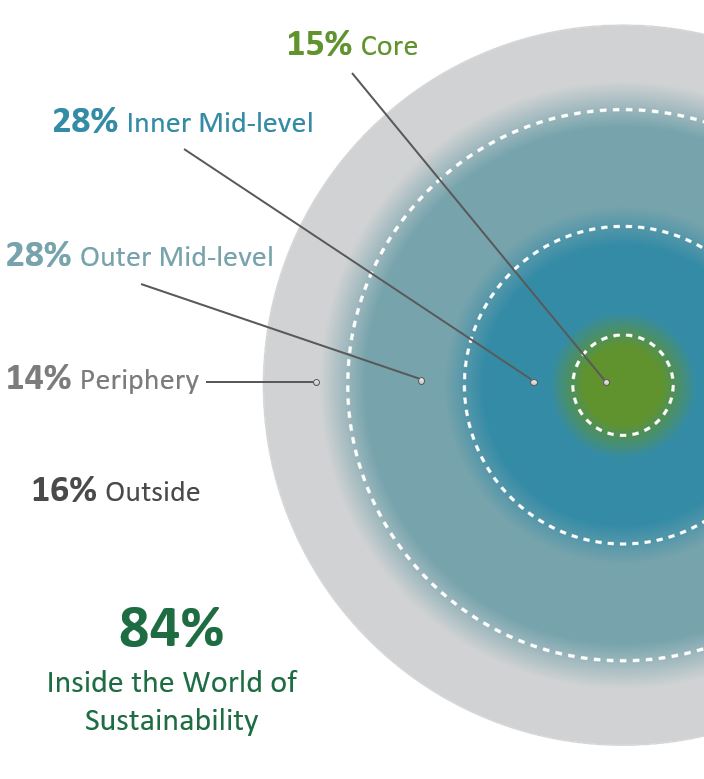

Sustainability refers to an interconnected set of values, beliefs and attitudes tied to a sense of responsibility for the greater good over the long term. The World of Sustainability incorporates both environmental and social elements.

84% of consumers participate in sustainability in some way, acting on this sense of responsibility in their own lives, or at least wanting to. This classifies them as within the World of Sustainability. An individual consumer’s position in the World indicates how deeply they engage with these matters.

Core consumers are the most highly engaged with sustainability, holding the strongest attitudes, knowing the most about sustainability topics, and most frequently acting on their sustainability values and beliefs.

Mid-level consumers adopt views and behaviors pioneered by the Core. They exhibit varying degrees of familiarity with and interest in sustainability issues and try to build sustainable habits into their lives but will not significantly alter their lifestyles for the sake of sustainability.

Periphery are the least engaged, with limited knowledge about sustainability. While they may have aspirations around sustainability, their actual behavior often deprioritizes sustainability in favor of other concerns.

Those outside the World tend to actively reject values and attitudes related to sustainability.

Segmentation based on reported respondent behavior regarding: animal testing, packaging, community issues, supporting companies helping local community, recycling, price, willingness to change lifestyle. Base: Total n=2202.