Slight decline in meals per day leads to more snacking

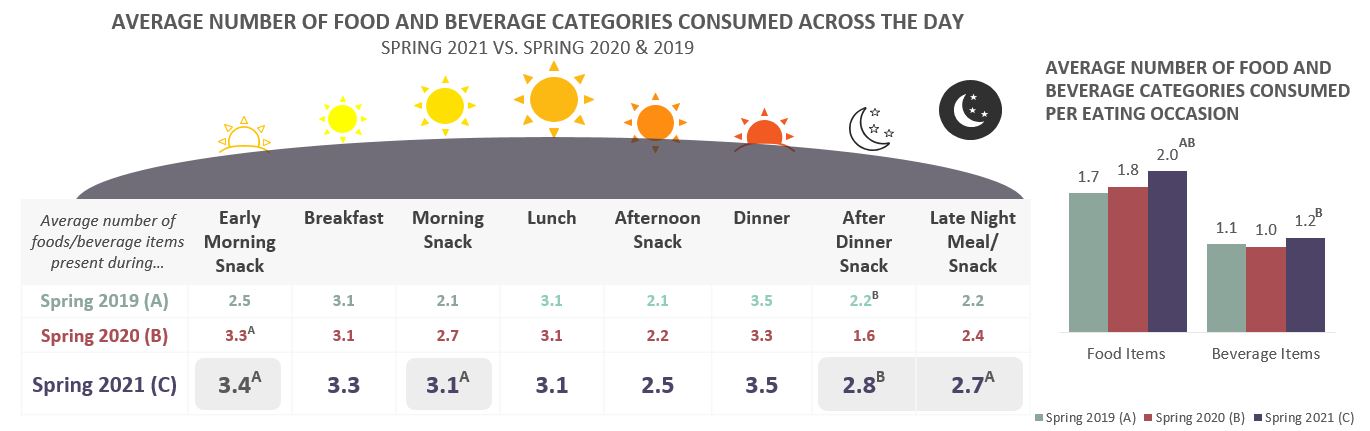

The average number of food and beverage categories present at any given occasion has increased significantly, reaching 3.1 items in spring 2021 (vs. 2.8 items in both spring 2019 and spring 2020). Morning and after-dinner snacking occasions are playing a more important role in consumers’ daily eating behaviors—all witnessing significant increases in the number of food and beverage items present compared to pre-pandemic eating and reflecting the elevated role that snacks are playing in consumers’ food lives.

Potato Market Update

Movement and demand continue to be steady in the russet potato market. Volume on larger-sized russet potatoes continues to increase as growing areas are starting to harvest more large-size potatoes. This has caused pressure on the larger carton sizes, as the demand in the foodservice industry continues to struggle to recover from the pandemic.

Movement and demand continue to be steady in the russet potato market. Volume on larger-sized russet potatoes continues to increase as growing areas are starting to harvest more large-size potatoes. This has caused pressure on the larger carton sizes, as the demand in the foodservice industry continues to struggle to recover from the pandemic.

Growers in Minnesota are finishing up with their red potatoes this week. North Dakota growers are shipping and storing their red potatoes.

All yellow potato shipping areas are up and running, looking for business. Demand has been steady. Growers are looking forward to the upcoming holiday season to increase the yellow potato movement.

The northeast has plenty of white potato supply, with a majority of the product staying on the east coast. Pricing remains very steady.

There are abundant supplies of red, yellow and purple fingerlings available throughout all shipping areas. This is the time to promote fingerling potatoes. Every area is looking for more movement.

Onion Market Update

Growers throughout Idaho and the Columbia Basin are nearing the end of harvest. Overall yields and size profiles on reds and yellows are down this year. This is a result of the excessive heat and smoke during the growing season. Demand is excellent on all three colors. Medium-sized onions are softer due to excess supply, while jumbo and larger-sized onions are in great demand.

Growers throughout Idaho and the Columbia Basin are nearing the end of harvest. Overall yields and size profiles on reds and yellows are down this year. This is a result of the excessive heat and smoke during the growing season. Demand is excellent on all three colors. Medium-sized onions are softer due to excess supply, while jumbo and larger-sized onions are in great demand.

Transportation continues to remain challenging, with higher than normal rates.

Restaurants have been facing numerous challenges over the last two years. From COVID restrictions to labor shortages, the struggles have been endless. Now, the foodservice industry is facing disruptions in the supply chain. To quote one restaurant owner: “The supply chain is changing what people will be eating for the rest of the year and beyond.”

When the CDC changed its recommendations earlier this year, along with the lifting of mask mandates and increased capacity limits in restaurants, the industry was ready for a comeback but the supply chain was not. The pandemic shutdown, production shortages and labor shortages were just a few of the reasons the system wasn’t ready.

The labor shortage in transportation and in distribution warehouses directly affected the industry. Early pandemic layoffs, drivers retiring, demand for local retail deliveries, unemployment assistance, and the want to move out of the foodservice industry, have made the labor pool shrink. Major foodservice companies have had to either cut or in some cases temporarily eliminate, deliveries to some customers due to lack of drivers, warehouse help and product shortages. This has forced many restaurants to look for products at warehouse clubs etc., which increases costs to already slim margins. Some have had to shut down one or two days per week due to short staff and lack of product.

This will create an impact on the entire foodservice industry. Whether it is due to shrinking menu options or operating days, fewer meals are going to be served and fewer products will be sold. Many experts have said this could last through 2022. The hope is with wages rising and benefits improving it will lure people back into these jobs, but that will take time.

With the need to pay higher wages, potential service disruptions and the price of products going up, the concern is many restaurant owners are wondering if it still makes sense to remain open. With the number of restaurant closings since the beginning of COVID, this should be concerning for all.